Built by Industry Veterans

Developed by a team of veteran hedge fund managers with over 20+ years of combined experience in quantitative trading and market analysis.

Trusted by leading financial institutions

Multi-Agent System

Multiple AI agents working together to analyze different aspects of the market simultaneously.

- Market trend analysis

- Competitor tracking

- Industry insights

Advanced Analytics

Comprehensive financial analysis and predictive modeling powered by AI.

- Technical analysis

- Sentiment analysis

- Risk assessment

Real-Time Monitoring

24/7 market monitoring with instant alerts and notifications.

- Price alerts

- Market news

- Trading signals

Start Monitoring Today

Join thousands of traders and investors who trust our AI-powered platform for their market analysis.

Multi-Agent Ecosystem

Our AI agents work together in a sophisticated ecosystem, sharing insights and collaborating to provide comprehensive market analysis

Technical Analyst Agent

Advanced pattern recognition and technical indicator analysis

- Chart pattern recognition

- Technical indicator analysis

- Support/resistance levels

News Analyst Agent

Real-time news monitoring and sentiment analysis

- Sentiment analysis

- Breaking news alerts

- Market impact assessment

Fundamental Analyst Agent

Deep financial statement and business model analysis

- Financial ratio analysis

- Growth trend analysis

- Industry comparison

Valuation Agent

Comprehensive company valuation and price target analysis

- DCF modeling

- Comparable analysis

- Fair value estimation

Earnings Call Agent

Earnings call analysis and key insights extraction

- Transcript analysis

- Key metrics tracking

- Management sentiment

Risk Assessment Agent

Comprehensive risk analysis and monitoring

- Market risk analysis

- Volatility forecasting

- Risk factor identification

AI Innovation, Human Excellence

Our AI-driven trading strategies are continuously monitored and refined by a team of experienced financial professionals

Professional Strategy Oversight

Our team of veteran traders and risk managers continuously monitor and optimize AI-generated strategies

Strategy Monitoring

- 24/7 performance tracking

- Real-time risk assessment

- Market condition analysis

Risk Controls

- Position size limits

- Volatility adjustments

- Exposure management

Backtesting Oversight

- Historical performance validation

- Strategy stress testing

- Risk scenario analysis

Years Average Experience

Strategy Monitoring

Comprehensive Data Coverage

Our AI agents are trained on extensive historical and real-time data across multiple asset classes and data types

Stock Market Data

- Historical price data since 1990

- Intraday data for active trading

- Corporate actions & splits

Forex Data

- Major & minor currency pairs

- Tick-by-tick historical data

- Real-time forex feeds

ETF Coverage

- Global market ETFs

- Sector-specific funds

- Commodity & specialty ETFs

News & Sentiment Data

- Financial news archives

- Social media sentiment

- Real-time news feeds

Earnings Call Data

- Transcripts & audio recordings

- Sentiment analysis

- Key metrics extraction

Pattern Recognition

- Technical patterns database

- Market behavior analysis

- Pattern success rates

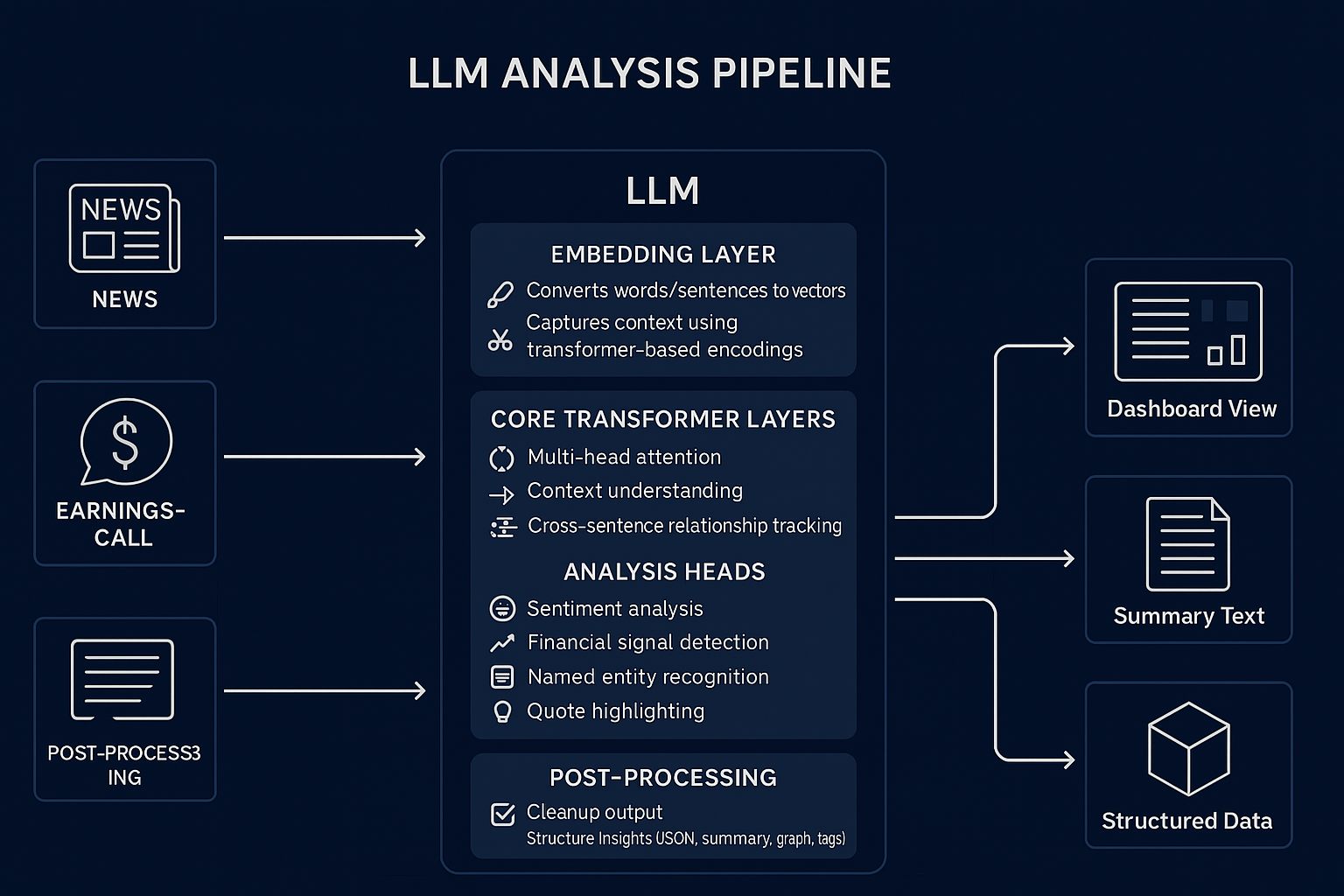

Advanced LLM Analysis Pipeline

Our sophisticated LLM pipeline processes thousands of financial documents daily, filtering noise and extracting actionable insights

Input Processing

- Real-time financial news ingestion

- Earnings call transcripts analysis

- SEC filing document processing

Noise Filtering

- Duplicate information removal

- Irrelevant content filtering

- Sentiment bias correction

Insight Extraction

- Key metrics identification

- Market sentiment analysis

- Strategic insights generation

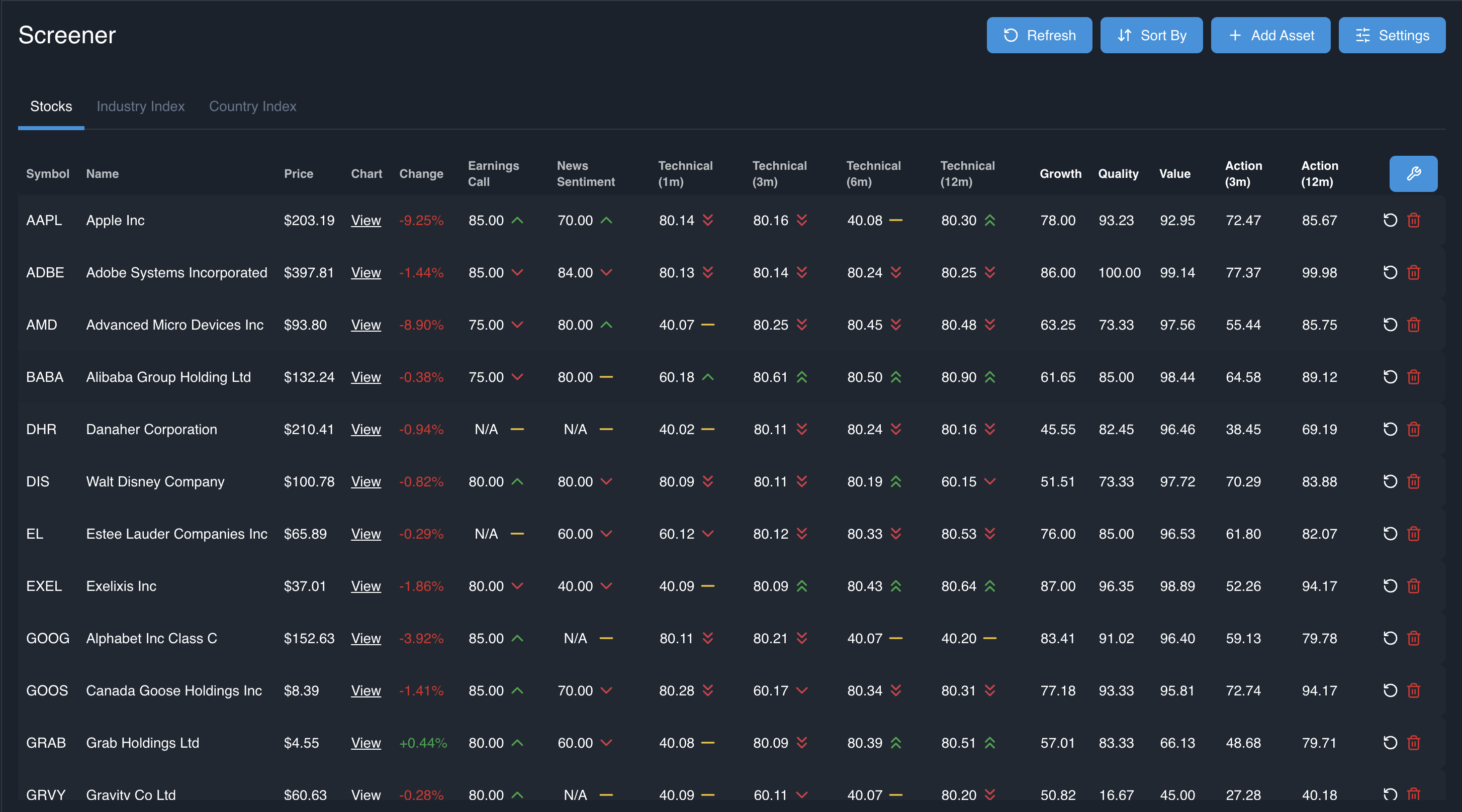

Proprietary Scoring System

Our AI agents utilize a comprehensive scoring mechanism that evaluates multiple aspects of market opportunities

Fundamental Score

- Financial health metrics

- Growth potential analysis

- Asset utilization

Technical Score

- Price action analysis

- Momentum indicators

- Volume patterns

Industry Monopoly Score

- Market share analysis

- Barrier to entry assessment

- Network effects

Competitiveness Score

- Competitive advantage

- Industry positioning

- Market dynamics

Financial Sentiment Score

- News sentiment analysis

- Social media monitoring

- Analyst sentiment

Earnings Call Score

- Management confidence analysis

- Forward guidance assessment

- Question response quality

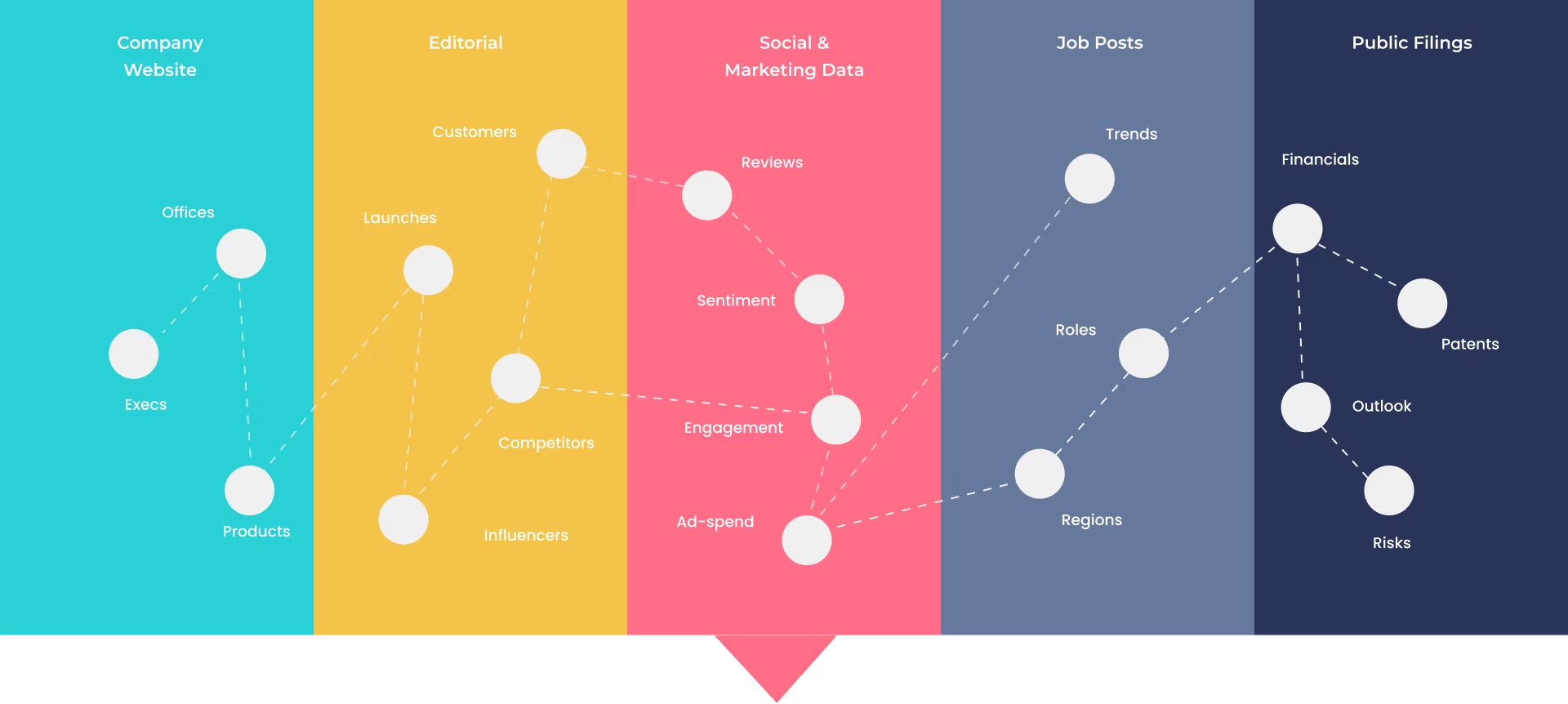

Industry Knowledge Graph

Our proprietary knowledge graph continuously learns and evolves, mapping complex relationships across industries

Historical Pattern Learning

- Market cycle analysis

- Industry evolution patterns

- Trend identification

Product Development Tracking

- Innovation pipeline analysis

- R&D investment tracking

- Patent analysis

Opportunity Signals

- Market gap identification

- Growth potential signals

- Disruption indicators

Dynamic Knowledge Graph

Our AI continuously maps and updates relationships between companies, products, technologies, and market trends

Choose Your Path

Whether you're an institution looking to develop custom AI solutions or an individual trader seeking powerful market insights, we have you covered.

For Institutions

Develop custom AI agents tailored to your investment strategy

Custom Solutions

- Tailored AI agents for your specific strategies

- Integration with existing systems

- Dedicated support team

Enterprise Features

- Custom model training

- Advanced security features

- API access

For Individual Traders

Connect our AI agents to your Interactive Brokers account

Trading Integration

- Direct Interactive Brokers connection

- Real-time trading signals

- Portfolio monitoring

Personal Features

- Customizable dashboards

- Mobile app access

- 24/7 market monitoring

Let AI Monitor Your Portfolio

Stop watching charts all day. Our AI agents monitor markets 24/7 and alert you only when it matters.

Our AI agents handle the complex task of market monitoring, letting you focus on what matters most - making informed investment decisions.

No credit card required. 14-day free trial.